Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

MSCI takes $190mn Stake in Burgiss Group

The Great Data and Analytics Race

The past week saw the announcement of two new partnerships as consultants to both the buy and sell-side seek to better serve their clients in the illiquid markets.

CEPRES, a provider of analytics and data exchange for private equity and other illiquid asset classes, announced this week it had formed a partnership which will allow Bain & Co to access insights and tools which promise to deliver ‘new levels of value’ for its private equity GP clients.

In other news, leading custodian BNP Paribas took a strategic stake in AssetMetrix, allowing it to expand and digitize its services to clients and investors through the provision of analytics and reporting tools dedicated to the analysis of private capital asset classes.

These two new partnerships mark the continuation of a trend where consultants and custodians are making moves to better serve a client base which is crying out for more robust reporting and analytical tools.

Another notable deal in September saw multi-asset class portfolio monitoring specialist Solovis partner with State Street to facilitate improvements to the Powered by DataGX product. And of course, Blackrock’s acquisition of eFront opens up opportunities for products which encompass entire investment portfolios. Other notable firms in the space such as Burgiss, which recently unveiled a new and improved UI, also maintain important custodian relationships.

What is fueling this trend?

The term ‘alternative’ assets is looking increasingly outdated as institutional investor allocations to private capital asset classes rise and grow in sophistication. With more products to choose from in more areas, and with more means of accessing investments (funds, direct, co-investments, separate accounts etc), there is an increasing demand for high-quality data and analytics as allocators seek to more effectively monitor and manage their portfolios.

This demand is also extending to firms advising and managing assets, and could prove to be a key factor in this already competitive market.

What are the Key Features?

Products in this area pack a lot of functionality into their platforms, but there are some key areas which can act as real differentiators:

Data Ingestion

In order to provide robust analytics, investment data must be entered into the platform in a timely and accurate manner – an activity made challenging due to inconsistent (and in some cases outdated) reporting standards. Providers in this space such as Chronograph are increasingly using the latest technology to automate elements of the ingestion process, while many offer analyst services to manage the process on behalf of clients.

It is likely that both pressure from LPs and groups such as the ADS Initiative will result in higher quality, more standardized reporting from GPs, making this piece of the puzzle less of a headache in years to come.

Data and Analytics

Here’s where things get really interesting. There are really three main types of data at play in the industry today:

User Data: which is completely transparent and granular at both the fund and portfolio company level

Benchmarked User Data: which lacks transparency, but is granular at both fund and portfolio levels.

Market Data: which is completely transparent, but lacks granularity especially at the portfolio company level.

Platforms in the industry today have a mix of these three elements forming the basis of the data layer which power the analytics, and each has an essential part to play:

User data is the core piece, showing the user how they are performing over time, helping to illuminate exposure to different industries and geographies, facilitating cash flow modeling, VaR and much more.

Benchmarked user data aggregates client data to produce granular, anonymized benchmarks based on large datasets. These benchmarks, such as those produced by Burgiss and CEPRES, are robust in that they do not suffer from survivorship or reporting bias and offer a level of granularity which transparent market data providers cannot match.

Market data providers (such as Pitchbook and Preqin), while not as granular, are necessary to show how specific firms have performed and form an important component of the fund discovery and due diligence piece which is so important in today’s complex marketplace.

Pressure is growing on technology providers to utilize all three areas effectively. We are also seeing the emergence of a fourth piece, which is the voluntary, case-by-case provision of portfolio company-level granularity to non-investors over a platform to facilitate fund discovery as GPs take a more long-term approach to capital raising.

Winners in this space will be those that manage the relationships, partnerships and technology required to bring these data elements together, layering analytics to facilitate deep understanding for their users. Add in fund discovery functionality and the ability to conduct both primary and secondary transactions and you have the making of a truly ‘killer app’ for the private capital markets.

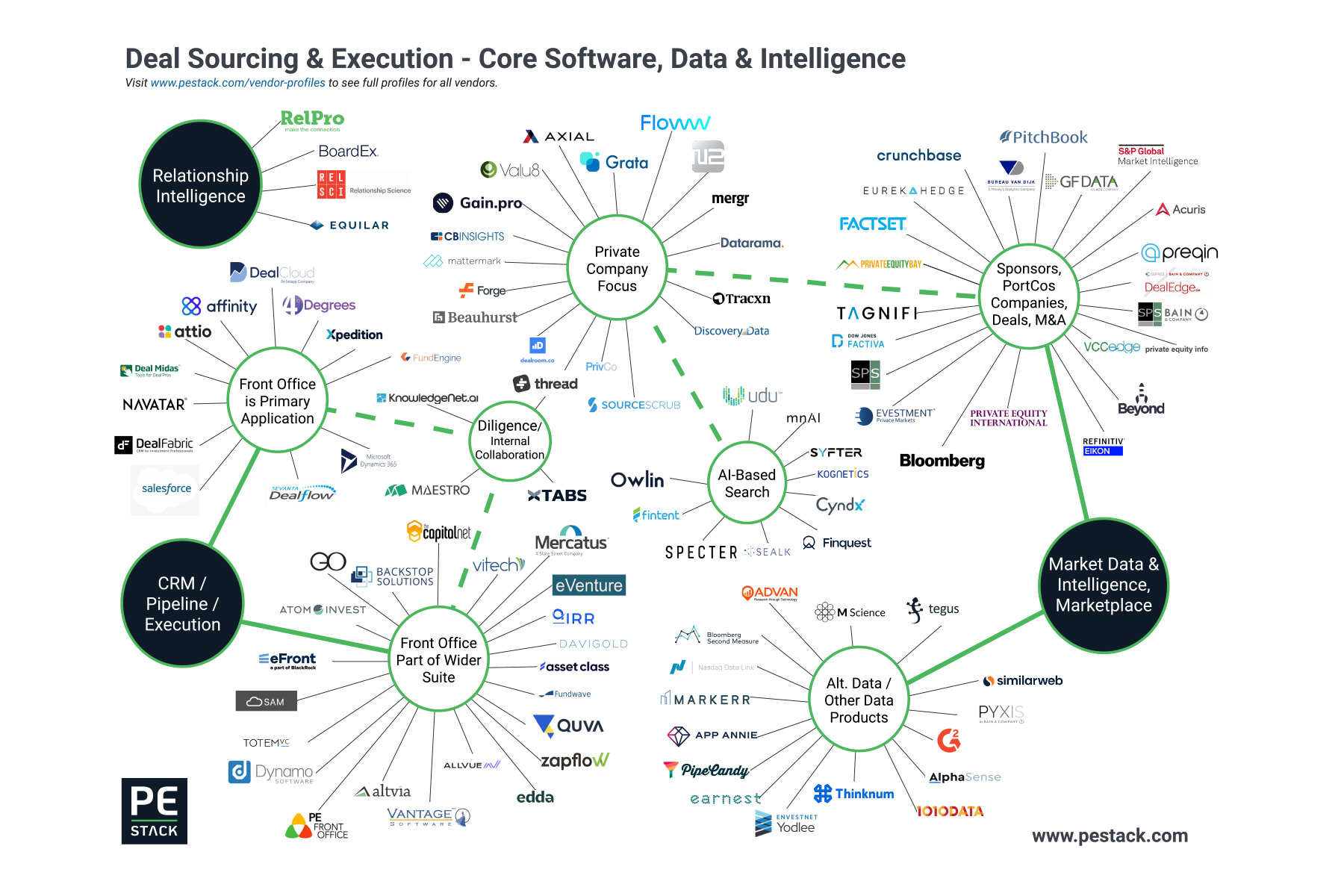

Please visit PE Stack’s Vendor Profiles to see more information on all the companies mentioned in this piece and over 100 more!

Vista Acquires AltaReturn, merges with Black Mountain to create Allvue

Vista Equity Partners has acquired AltaReturn, the provider of end-to-end, Microsoft based software suites. The builder of private capital and family office enterprise software solutions will be merged with existing Vista portfolio company Black Mountain Systems, a builder of innovative, workflow solutions that service a wide variety of closed and open-ended assets classes.

“We’re honored to be joining forces with both the world’s premier software investor, Vista Equity Partners, and with market leader, Black Mountain,” said Allvue CEO and AltaReturn co-Founder, Rey Acosta. “This combination marks a monumental leap forward for fund managers, investors and administrators in the alternative investments industry. Our commitment to Allvue’s clients is straightforward: to develop the most innovative technology in the market while providing an exceptional level of client service."

The newly merged firm will be known as Allvue Systems. At PE Stack we are eager to see what will happen when AltaReturn’s deep expertise in front, middle and back office software combines with Black Mountain’s wide array of services, including: portfolio management, trade order management, compliance, research management, investment accounting, performance attribution, customer relationship management, investor reporting, enterprise data management and data warehousing.

A combined management team will lead the merged entity with AltaReturn co-Founder Rey Acosta as CEO. Black Mountain’s co-CEO, Kevin MacDonald, will serve as COO of Allvue.

Black Mountain’s clients consist of many of the world’s leading investment managers, credit funds, hedge funds, private equity, direct lenders and banks which use the company’s platform to manage all varieties of loans, fixed income, alternatives, derivatives, equities, and FX. AltaReturn count many major closed-ended fund managers amongst their client-base, including Oak Investment Partners and Menlo Ventures.

The past few years have seen software suppliers previously focusing on one specific area shifting toward providing a suite of services ranging from front to back office. While it is now normal for providers to be supplying a wide range of connected products, AltaReturn has been more successful than many in getting clients to adopt the entirety of their suite and benefit from the interconnectedness of data across different firm functions. It will therefore be interesting to see how the combination of AltaReturn’s platform with Black Mountain will further enhance the value propositions of the newly combined companies and what this will mean for existing clients of the two firms.

Deutsche Bank served as exclusive financial advisor to AltaReturn, and K&L Gates LLP was the company’s legal advisor. Jefferies LLC acted as financial advisor to Vista and Kirkland & Ellis served as legal advisor to the firm.

At PE Stack we are constantly monitoring the dynamic market for private equity and venture capital software and data. Over the past year, we have tracked numerous deals, partnerships and acquisitions on top of new products being launched and even a couple of companies closing up shop. You can see information of all active data and software businesses on our free to use Vendor Profiles platform, the industry’s leading source of software and data vendor intelligence.

eVestment Continues Data Expansion Drive with Preqin Integration

The growth of the private fund market is having a major impact on the dynamics of the software and data industry that supports it. For today’s allocators, there is enormous complexity in terms of the number of offerings to choose from and the breadth of strategies and industries being targeted. As the proportion of assets being placed in alternatives rises, the pressure to perform has never been higher.

Allocators, even those reliant upon consultants, are increasingly turning to software and data solutions to help them manage their programs effectively. We have seen a number of new products targeted toward this sector both from existing players expanding their offerings and start-ups seeking a foothold in a fast-growing market.

For me, eVestment has been one of the most interesting companies to track, and today sees the announcement of another data integration partnership to follow on from the recently announced deal with Pitchbook, with Preqin’s industry benchmarks make their way onto eVestment’s Private Markets product.

I feel that eVestment is taking a customer-centric approach to developing its suite of products, employing a willingness to work with widely-used datasets in order to increase existing clients’ satisfaction and better attract new users to its ecosystem. It’s a smart strategy.

Having a trusted source of market data is now an integral part of the portfolio management process for allocators serious about managing their programs effectively. Software solutions which do not facilitate the integration of trusted market data sources will increasingly find themselves at a disadvantage in an environment where this functionality is becoming more common. As I mentioned in an earlier article, users are also discerning when it comes to the quality of these integrations too.

It is encouraging to see software providers providing clients with multiple options when it comes to data integration. I have heard all the arguments about the relative strengths and weaknesses of the various databases and benchmarks, but the reality is that allocators need consistency. It is far easier to sell an allocator on an excellent analytics platform if they can immediately utilize the benchmarks which they are already using to track performance.

eVestment should be applauded for successfully taking a number of standalone products such as TopQ and Public Plan IQ and creating an interconnected suite of tools which is supported by high quality external data sources. The integration of Preqin data into the eVestment Private Markets platform reinforces eVestment’s commitment to giving their allocator clients exactly what they want and need to do their jobs effectively.

Solovis and Imagineer Activate Collaboration

Two prominent names in the alternatives software world are announcing a new partnership combining the quantitative strengths of the Solovis Platform with the qualitative tools of Imagineer’s Synap.

When it comes to tools for allocators, the most powerful applications are those which most closely align with the workflow of today’s professional investor. Maintaining an allocation to private equity and other alternatives is a process which incorporates multiple factors:

quantitative and qualitative due diligence on new managers

effective monitoring of existing portfolio including risk and exposure factors

research on the wider market and environment

The newly announced collaboration between Solovis and Imagineer will allow for the qualitative side of the portfolio management process to be integrated within the more quantitatively focused Solovis platform, which includes tools enabling investors to manage complex multi-asset portfolios with advanced data collection and standardization, reporting and analytics functionality.

Partnerships like this can be challenging to get right from the strategic business perspective, but if both partners have a shared vision and similar goals, it can be an effective strategy to quickly create a single platform with tools which are tried and tested. Given the complexity in developing such functionality from scratch, the approach taken here can lead to a better end product more quickly and less riskily when compared with either firm developing similar products from scratch.

I feel that the strengths of Imagineer and Solovis are complementary in nature and this collaboration makes a great deal of sense. It will allow both Solovis and Imagineer to gain exposure to new customer-bases and provide additional value to mutual clients.

We know that shifting between multiple platforms to complete tasks can be inefficient and adds risk to any process. Today’s LPs and GPs are operating in an environment which is increasingly complex with allocators in particular facing more choice than ever in terms of funds on the road and the strategies they are employing. Whether through partnerships, acquisitions or new developments, effective integration of complementary tools with a single source of data is increasingly important to the modern institutional investor.

Here is the link to the official release

PE Stack’s thoughts on Pitchbook and eVestment’s Data Partnership

Two of the leading names in the private fund data world recently announced a partnership that sees Pitchbook’s fund performance and firm data available to users of eVestment’s Private Markets product. In addition, Pitchbook’s benchmarks will also be accessible to eVestment users.

What PE Stack says:

Since the NASDAQ acquisition, eVestment has been one of the most exciting vendors to watch, with this deal the latest in a series of acquisitions and partnerships that have enabled them to gather serious momentum in the private fund space.

I know first-hand that building and maintaining a high-quality source of performance data is tough, both in terms of assembling the data set in the first place, but perhaps more importantly in terms of building a good reputation. Pitchbook is one of a select group of trusted vendors with performance data and benchmarks which are high-quality and suitable for vital tasks such as due diligence.

I believe that by partnering with Pitchbook instead of building a competing dataset, eVestment put themselves in a strong position where their excellent tools and analytics can be accessed without having to convince users to switch to a new set of benchmarks and performance metrics. Don’t under-estimate how important consistency is for many GPs and especially LPs in the space.

It’s a smart strategy that will allow eVestment to attract new clients at a fast pace – especially on the GP and LP side. For Pitchbook, this move cements their position as a trusted provider for fundraising and due diligence data, and will increase their exposure to end-users on both the supply and buy side of the fundraising market.

I expect to see more deals which bring external data sets directly into eVestment’s growing ecosystem. Their mix of high-quality internal data products (Public Plan IQ), powerful tools (TopQ) and willingness to incorporate external data sources is unique in the market today. What makes the offering especially compelling to me is the effort that eVestment have put into integrating their portfolio of products into a powerful, inter-connected suite.

For more information on the specifics of the deal, please see the information page here:

https://www.evestment.com/privatemarkets/pitchbook-data-partnership/