PE Stack and Holland Mountain present the first initiative to map AI / GenAI use cases and key vendors in Private Equity and wider private capital.

Market Data Integration: 5 Key Considerations

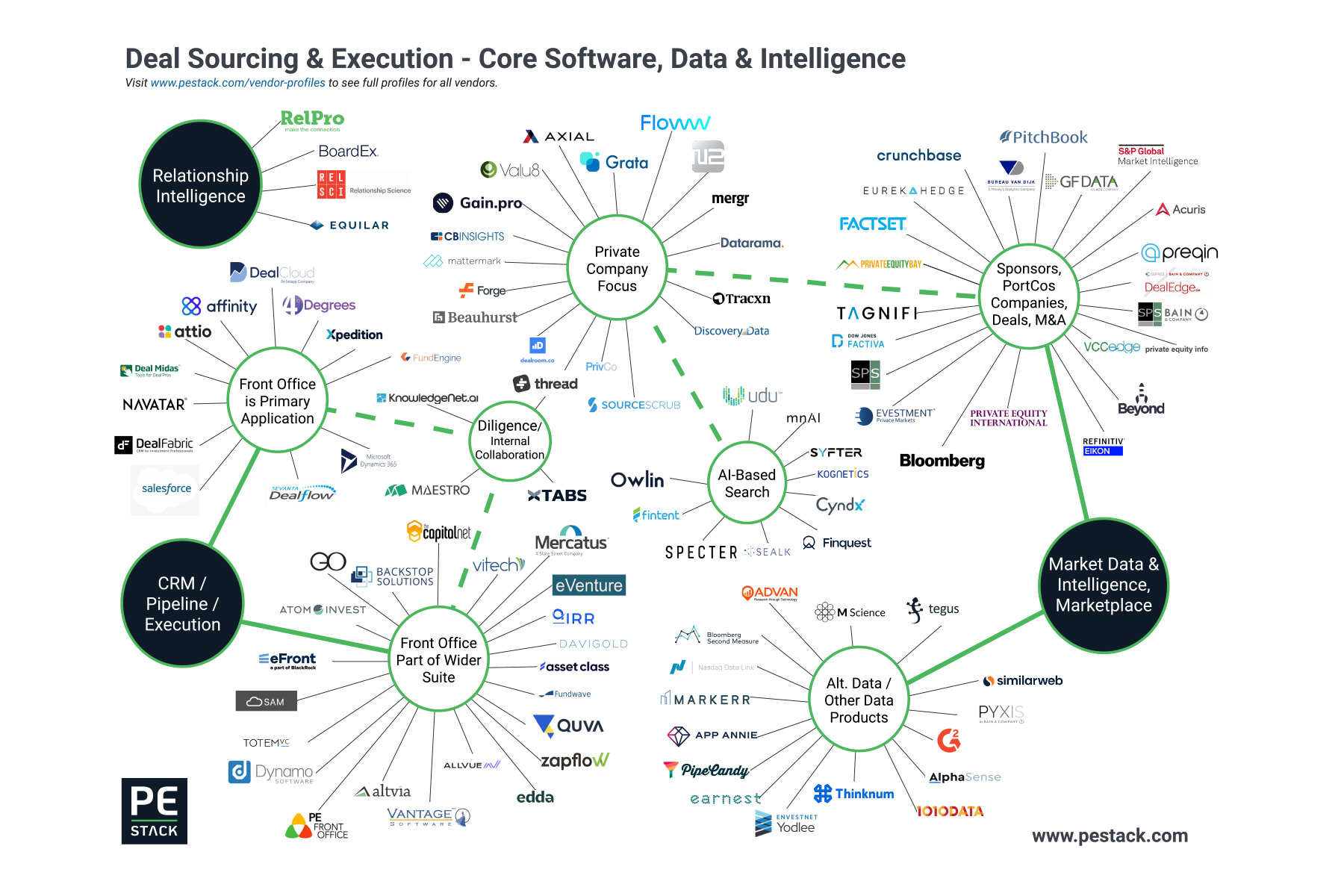

A software platform’s ability to integrate with leading industry market data sources is a key consideration criteria often subject to false assumptions and misinformation. In an effort to improve the alignment of expectations between buyers and sellers of private capital software and data, we’ve identified the five most important considerations to ensure no nasty surprises during implementation.

Why PE Firms Need a Data Strategy

For private equity firms, data forms the foundation from which opportunities are uncovered, decisions made and competitive advantages built. A robust strategy for the collection, structure and maintenance of data should therefore be of critical importance… but is all too often neglected or completely ignored.

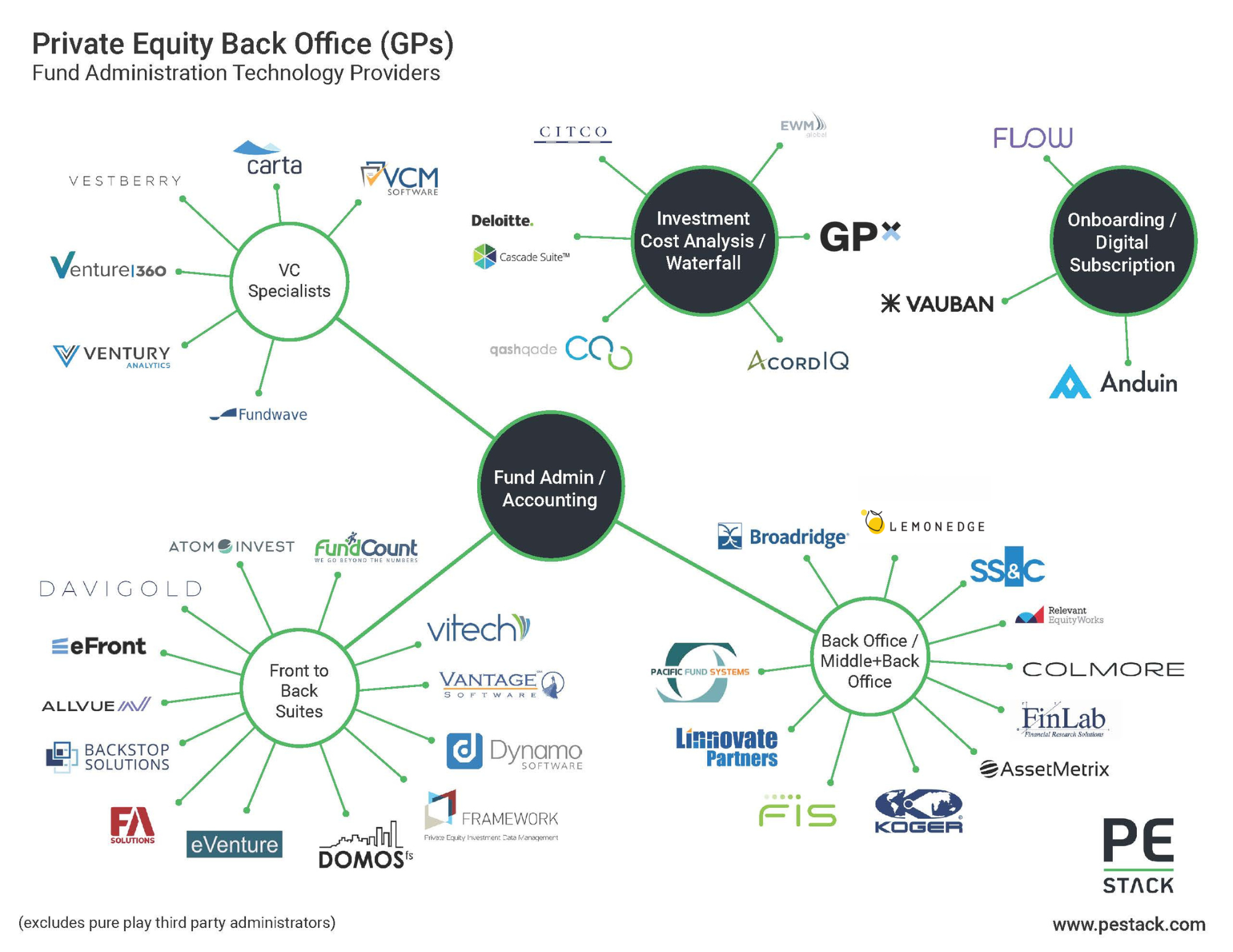

Private Equity Back Office Solutions Map - Fund Administration Technology, Waterfall Calculation, Subscription and Onboarding

Procurement Sucks! The New PE Stack Service Explained

Selecting technology and data providers doesn't have to be a distracting and confusing drain on resources. The current procurement model is broken, but we have a solution. This article explains the core issues with typical procurement in contrast with our free procurement service which helps PE firms and LP investors identify, assess and implement vendors with incredible efficiency and confidence.

Virtual Analysts - the future of proprietary deal sourcing?

Our latest special report, produced in collaboration with udu, examines emerging 'Virtual Analyst' technology and the increasingly important role it's playing in proprietary deal sourcing channels:

What is a 'Virtual Analyst'?

How does the technology work?

Why is it so important in the current market?

How does adoption affect existing sourcing processes?

How are Private Equity and Venture Capital Tech Firms Funded?

An LP's Fiduciary Duty?

In a ‘buyers’ market’ fundraising environment, the onus tends to fall on fund managers to adapt and prepare for a demanding and extended process. But what about LPs? After all, almost all LPs have a fiduciary responsibility to their stakeholders to engage in a best-practice fund sourcing process. As the ratio of available funds to planned commitments gets ever-larger, LPs must also consider how their processes must evolve if they are to retain confidence in their ability to select the best funds.

Coronavirus and Fundraising: The Return of the Denominator Effect?

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.