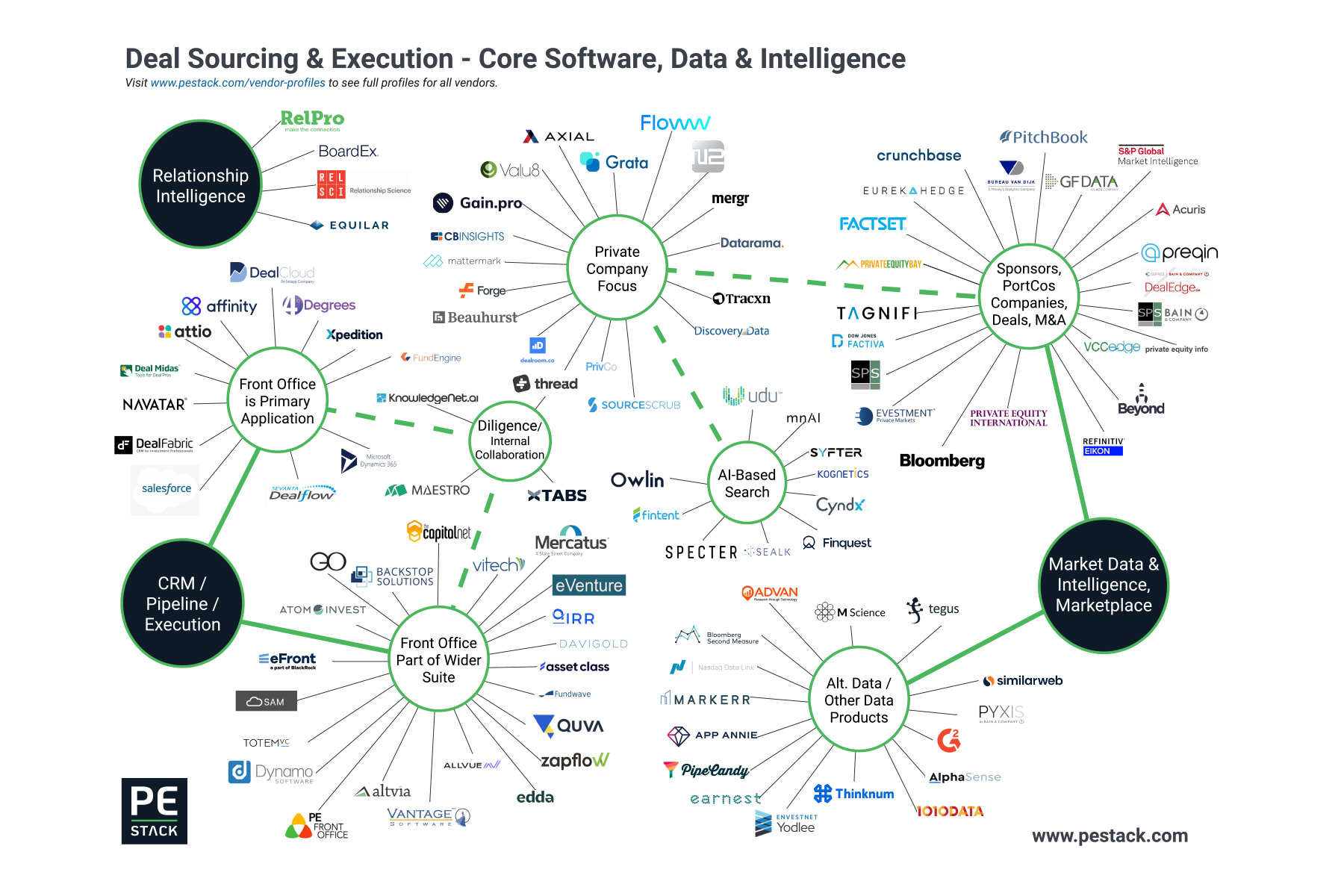

PE Stack's solutions map shows all private equity and venture capital specialized technology, software and data vendors providing services in the CRM and wider front office space alongside concise descriptions of the different technologies being used in this area.

The Dynamo Effect: Imagineer The Latest Major Acquisition For Francisco-Backed Vendor

An LP's Fiduciary Duty?

In a ‘buyers’ market’ fundraising environment, the onus tends to fall on fund managers to adapt and prepare for a demanding and extended process. But what about LPs? After all, almost all LPs have a fiduciary responsibility to their stakeholders to engage in a best-practice fund sourcing process. As the ratio of available funds to planned commitments gets ever-larger, LPs must also consider how their processes must evolve if they are to retain confidence in their ability to select the best funds.

Affinity adds Pitchbook Integration

Affinity, a leading relationship intelligence platform (click here to view our primer on Relationship Intelligence) today announced a new integration with Pitchbook, a leading provider of financial data and technology.

Users of Affinity will now be able to see additional investor and company data directly on the Affinity platform, allowing for:

Companies: Get information on the industry, location, demographics, financing, assets under management, and more on both public and private companies.

Investors: Review details on a company’s investors and assess fund performance to gauge their experience.

Funding: Explore granular funding data, including funding type, amount, date, and post-money valuation.

If you are an Affinity user (full disclaimer, PE Stack uses Affinity and we love it) then you won’t need any further explanation. But for the uninitiated , here’s why this integration is so important.

Affinity helps its users to understand relationships and improve business development and outreach through its intelligent mapping and prediction models. Adding sources of third party data allows for:

More intelligent outreach: through allowing users to better understand a target company’s current situation with funding, financial status etc.

The discovery of new and adjacent routes to forming relationships: by seeing which companies worked with other companies. For example, discovering and then leveraging existing relationships with investors in a target company to gain warm introductions.

Saving valuable time: by eliminating the need to have two platforms open at the same time, searching via two different platforms, manually importing information.

In order to access the data, users will need access to both platforms.

For more information on Affinity, Pitchbook, and other data and relationship intelligence tools, please view our free Vendor Profiles platform, or give us a call at our Los Angeles office - +1 818 964 1576

Vista Acquires AltaReturn, merges with Black Mountain to create Allvue

Vista Equity Partners has acquired AltaReturn, the provider of end-to-end, Microsoft based software suites. The builder of private capital and family office enterprise software solutions will be merged with existing Vista portfolio company Black Mountain Systems, a builder of innovative, workflow solutions that service a wide variety of closed and open-ended assets classes.

“We’re honored to be joining forces with both the world’s premier software investor, Vista Equity Partners, and with market leader, Black Mountain,” said Allvue CEO and AltaReturn co-Founder, Rey Acosta. “This combination marks a monumental leap forward for fund managers, investors and administrators in the alternative investments industry. Our commitment to Allvue’s clients is straightforward: to develop the most innovative technology in the market while providing an exceptional level of client service."

The newly merged firm will be known as Allvue Systems. At PE Stack we are eager to see what will happen when AltaReturn’s deep expertise in front, middle and back office software combines with Black Mountain’s wide array of services, including: portfolio management, trade order management, compliance, research management, investment accounting, performance attribution, customer relationship management, investor reporting, enterprise data management and data warehousing.

A combined management team will lead the merged entity with AltaReturn co-Founder Rey Acosta as CEO. Black Mountain’s co-CEO, Kevin MacDonald, will serve as COO of Allvue.

Black Mountain’s clients consist of many of the world’s leading investment managers, credit funds, hedge funds, private equity, direct lenders and banks which use the company’s platform to manage all varieties of loans, fixed income, alternatives, derivatives, equities, and FX. AltaReturn count many major closed-ended fund managers amongst their client-base, including Oak Investment Partners and Menlo Ventures.

The past few years have seen software suppliers previously focusing on one specific area shifting toward providing a suite of services ranging from front to back office. While it is now normal for providers to be supplying a wide range of connected products, AltaReturn has been more successful than many in getting clients to adopt the entirety of their suite and benefit from the interconnectedness of data across different firm functions. It will therefore be interesting to see how the combination of AltaReturn’s platform with Black Mountain will further enhance the value propositions of the newly combined companies and what this will mean for existing clients of the two firms.

Deutsche Bank served as exclusive financial advisor to AltaReturn, and K&L Gates LLP was the company’s legal advisor. Jefferies LLC acted as financial advisor to Vista and Kirkland & Ellis served as legal advisor to the firm.

At PE Stack we are constantly monitoring the dynamic market for private equity and venture capital software and data. Over the past year, we have tracked numerous deals, partnerships and acquisitions on top of new products being launched and even a couple of companies closing up shop. You can see information of all active data and software businesses on our free to use Vendor Profiles platform, the industry’s leading source of software and data vendor intelligence.

DealCloud and Preqin: What Makes Integration Powerful?

Market data integration is an increasingly important feature for CRM end-users; such partnerships are common in the industry with Preqin and other providers’ data available on a variety of platforms.

With DealCloud joining the list of partners for Preqin data, I want to take this opportunity to examine what makes for a best practice integration project.

“Data Integration is not just a box ticking exercise”

I seriously question whether the people who developed my car’s terrible Bluetooth integration have ever used a cellular phone or operated a motor vehicle. It takes a good 30 seconds to activate, fails to show the name of anything other than the first track I play on Spotify and will sporadically disconnect for no reason. Incoming calls require the pressing of multiple buttons as I urge the caller to be patient and not hang up. Conversely, my wife’s car connects instantly, shows album covers while playing music, and deals with calls flawlessly.

When it comes to integration, not all developments are equal. To avoid frustration down the line, here are some of the key things to look for when assessing the quality of this vital feature:

What is powering the integration?

There are two ways in which data can be pulled into a platform. API integration is best practice, pulling data directly from the source in real time. The alternative is a periodic data dump which can sometimes be easier to develop from a technical perspective, but can be inferior in terms of the timeliness of data if not refreshed often. This might not sound like such a big deal, but for data sets where news can dictate activity it can make a significant difference. For example, a live or near-live feed of Preqin’s LP news can help fundraisers to react quickly to relevant updates which might otherwise be missed with a weekly or monthly refresh.

What data and functionality is being included?

Preqin, Pitchbook and other market data providers maintain numerous datasets, encompassing LPs, GPs, fundraising, performance, deals and more. When considering a CRM, examine the breadth of integration with your favored data provider and the depth of data. A good integration would not see you switching back and forth between platforms due to insufficient detail being carried across. Another related factor is functionality - does the integration allow for the discovery of previously unknown entities via a search on the CRM platform?

What are the subscription terms?

Data providers will often encourage existing clients to add more users, providing added value which is subsequently captured through increased fees. This can naturally cause conflict with CRM integration if there is any chance of a client gaining increased access without paying for it. I don’t see fees around integration as a bad thing if additional value is being offered, but make sure you know what the financial implications of an integration will be as you consider your overall budget and spend. Don’t assume that your single-user data license will translate into an enterprise-wide access via integration on the CRM side.

How is the UX?

I’ve seen a lot of integrations, some are integrated seamlessly into the workflow and work extremely well. I’ve seen some very clunky solutions which, like my car’s Bluetooth, don’t. A key part of the user experience will be how the integration deals with duplication and information asymmetry. You may know more than the data provider about an individual or entity. How is such disparity dealt with on the CRM side? Is there a single sign on process? Will the integration work on mobile? The better the UX, the more the data will be used and the more value it will add.

DealCloud and Preqin

The key point to take is that integration is not a box-ticking exercise and users should examine the quality of this important feature when assessing their providers. Different users will have different priorities, but the integration offered by DealCloud and Preqin appears to be a high-quality, thoughtful development. Data is being refreshed regularly from the live database which is a big plus, the breadth of data on LPs is significant and the functionality on the front end has been carefully considered with involvement from both the Preqin and DealCloud development teams based on feedback from mutual clients.

DealCloud is one of the names I hear most commonly when discussing CRM and is one of the fastest-growing platforms available today. Combined with Preqin’s data, which is especially strong for fundraising and fund investment purposes, this makes for a compelling front office solution.

Affinity takes total funding to $40.5mn with $26.5mn Series B round

Affinity, one of the fastest-growing and most talked about relationship intelligence platforms, just raised an additional $26.5mn with backing from Advance Venture Partners, Sway Ventures, MassMutual Ventures and Pear Ventures.

Affinity intends to use the new injection of funds to continue building out its platform.

The San Francisco-based company uses a machine-learning, technology approach to relationship management and CRM. I’ve had an opportunity to use the platform myself, and so far I’m very impressed with what they have built.

I intend to put together a more comprehensive overview of the solution once I’ve had more time to experience all the features, but here are some of my initial impressions:

Setup – the initial setup is really easy, it automatically populates based on your email account and immediately starts plotting relationship maps. I was up and running within minutes.

Import – the data import wizard is great, mapping fields is simple, and duplicates are dealt with automatically. I noticed very few glitches or issues here.

Built for PE – the team clearly ‘get’ private equity workflows such as fundraising and deals. There are some powerful inbuild tools here to help manage day to day activity, including a feature which alerts you to emails which require a response or follow-up automatically.

Built for lazy people – ok, lazy is perhaps not the best word. But we all have all worked with people who loathe CRM and hate to enter details of interactions they have had. I’ve seen people with their own personal spreadsheet (saved locally of course), or even the dreaded ‘human-brain-based-rolodex-combined-with-Outlook-search-function’ approach. Too bad you can’t clone brains when such employees depart!

Affinity is awesome for these people. It pulls data in from emails, automatically tracking relationships over time and helping users to stay on top of tasks. For people that are always on the road and don’t have time to be meticulous with CRM data entry, Affinity offers some great functionality. For example, if I were to receive an email from a new contact at a new firm, Affinity would log that interaction automatically, add a new firm entity on the platform and pull in any data on that entity from external sources to facilitate background research. For firms that struggle to get employees to add these things, this is a compelling feature.

As mentioned, the system automatically links your contacts with their companies and then pulls in external background data from a number of sources (such as Crunchbase) to provide background information. This is very useful and worked flawlessly for me. That said, I would like to see some additional industry databases available for integration here, especially on the LP side.

Relationship mapping works well. I’ve seen this kind of technology used before with mixed results, but the Affinity relationship mapping and ranking system is powerful and accurate – so if I want to find a path to talk to a company or individual, the platform will show my how I can get there via relationships I have. The platform even lets you add industry ‘Allies’ which can help to expand your ability to get high quality introductions.

My assessment so far is that Affinity is a powerful platform which offers some compelling functionality. It’s been designed with human nature in mind, pinpointing many of the areas where CRM can fail due to humans failing to update things properly. Seems to me that implementation should be straightforward compared with other CRMs I’ve seen, although I haven’t seen how things would fare for a big organization yet.

Look out for a proper in-depth view in the next few weeks…