Deal Sourcing & Execution

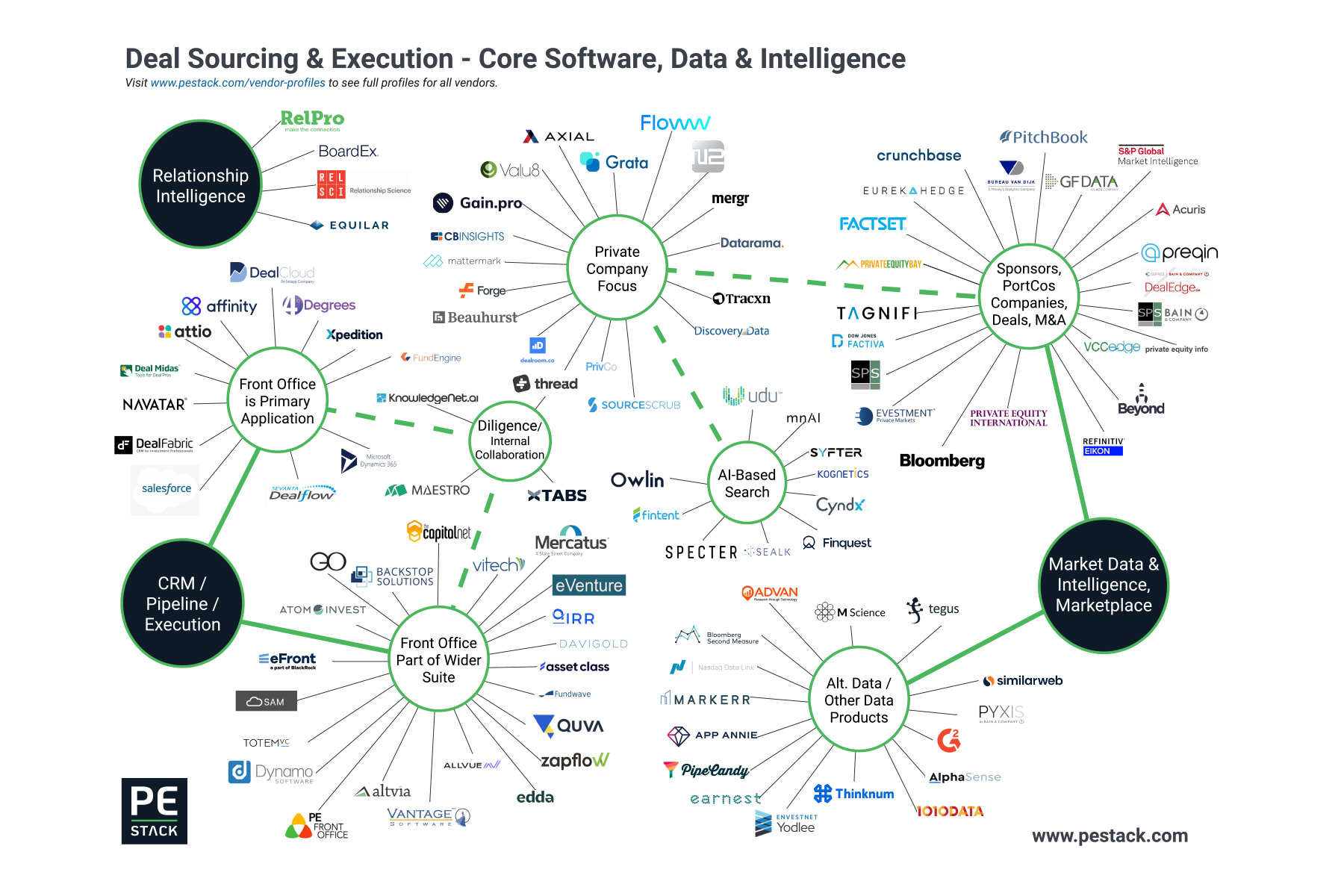

As the private equity and venture capital product universe expands, so does the challenge of building market maps showing which vendors do what while providing a realistic view of how products are split. Therefore, we find ourselves becoming increasingly granular and specific and this is certainly true of the front office where we are now producing a map showcasing deal sourcing as distinct from investor relations front office for the first time.

Front Office Software

Earlier maps showed Relationship Intelligence to be interwoven with CRM as we linked vendors which provided functionality around relationship mapping and scoring within a CRM application to both the Relationship Intelligence and CRM areas. Early pioneers within the CRM space leveraging this approach include Affinity and 4Degrees.

Over recent years, we have seen relationship intelligence tools of varying degrees of sophistication added to many CRM platforms and no longer feel it is appropriate to attempt to delineate between CRMs that do and do not provide such functionality, especially as this is not a black and white consideration. We, therefore, separate Relationship Intelligence tools which are standalone platforms; a key area of differentiation between such platforms and the functionality we see within CRM is the ability to leverage market data around people alongside proprietary internal data to surface actionable insights.

Within the CRM and deal pipeline space, we delineate between solutions which are mostly focused on the front office and those which offer a wider, interconnected suite of products. It is important to note that the positioning on our map does not correlate with the quality of the front office capabilities – so-called ‘point’ solutions are not automatically superior to wider ‘suite’ providers. We split things in this way as this aligns with how we see firms looking at the space, with certain buyers showing a preference for one approach or the other from the outset. We also include some solutions which have specific functionality addressing diligence which are not providing wider CRM.

Market Data, Intelligence, and Marketplace

We have evolved our thinking and coverage of this space, but there is still more work to be done here to really show how these products are differentiated.

The biggest change has been the addition of ‘Alt’ or alternative data vendors to our coverage. We see the use of such products as being relatively limited today, but this is an area many firms are starting to look at more seriously as they seek to gain an edge in deal sourcing and execution.

We are also separating out platforms leveraging AI to power searches based on external data or domain search technology where the results are specific to the client and not included as part of a wider database.

Within the more traditional market data provider space, we separate out vendors which maintain databases containing multiple data sets connected to deals from those which specialize more in providing private company data specifically. Again, we are not implying that vendor categorization here correlates with product quality. We split things in this way to align with how we see firms looking at these data products and making buying decisions.

There are many ways we can split market data products up and this is a very interesting area given that sophisticated firms tend to buy multiple data solutions and are looking to build a complementary portfolio of products. At some point, we will make a map entirely devoted to market data products which will go into greater depth in terms of showing who does what. Furthermore, we must stress that grey areas exist between different sub-categories and we apologize in advance if we are miscategorizing any solutions.

Missing Vendors!

We do our best to make these maps comprehensive, but please do let us know if you feel we are missing any solutions which should be present. In order to be included in this map specifically, we are looking for platforms with specific applications for sourcing deals. We will be covering other workflows in other maps.

In terms of inclusion at a more general level, PE Stack will track any platform that has a specific focus on private equity and venture capital. We do not include service providers within our maps, we avoid software or data products which are provided as part of a wider service offering and not available as a standalone.

We also tend to avoid products which are more generalist in nature but might be used within the private capital space (although we do include Salesforce and Dynamics here given their usage is so meaningful). This is especially important for the CRM space where there are many enterprise platforms which see some usage within our industry – Pipedrive, Hubspot, Streak, Sugar, etc - but lack specific workflows for private capital and frankly are too numerous for us to include comprehensively without making an already crowded map impossible to decipher.

Interested in learning more about vendors in the space? Click below to see all the maps we’ve created.

PROCUREMENT DOESN’T HAVE TO BE PAINFUL

We help LPs & GPs identify, qualify, and procure software, data, and technology solutions with our unique and comprehensive procurement as a service offering.

If you are thinking about your data and technology stack, we can help! Please leave your details below and we will be in touch.