PE Stack works with clients of all shapes and sizes seeking a wide range of tools and services across the entire spectrum of private capital use cases. Feel free to explore our ongoing and former project assignments below and please get in touch to learn more about how we can help you find the best products efficiently and confidently.

Active Projects

Front to Back Office

Type Buyout

Size Large

Location US/ Europe

Scope CRM, LP Lifecycle Management, Portfolio Monitoring

Status

RFI Open: Due March 8th by 5pm PTView Details

Middle Office

Type Fund of Funds / Secondaries

Size Large

Location US

Scope Portfolio Monitoring

Status RFI Closed, Selection Process

View DetailsFront to Back Office

Type Venture Capital

Size Large

Location US / Europe

Scope CRM; Portfolio Monitoring; Accounting, Reporting, Performance & Valuation; LP Onboarding; DDQ Engine; LP Portal; Document Management; KYC/AML

Status RFI Closed, Selection Process

View DetailsMiddle Office

Type Venture Debt

Size Large

Location Europe

Scope Loan administration/ portfolio monitoring

Status Vendor Landscaping

Front/Middle Office

Type Growth

Size Small

Location Europe

Scope CRM, LP Lifecycle Management, Value Creation Software

Status Vendor landscaping complete, selection underway

Middle Office

Type Buyout

Size Extra-Large

Location Global

Scope Portfolio Monitoring, Valuation

Status RFI (by invitation only) complete, initial demonstration phase

Please note, PE Stack conducts RFIs on a single-blinded basis - client identity will only be revealed to vendors selected by clients for assessment. Please review the full RFI using the link in the description for details and instructions on how to respond.

If you are a PE or VC firm, LP investor, or service provider interested in launching a single-blinded RFI, please get in touch using the form at the bottom of this page.

Example Closed Projects

Learn more about these projects by hovering over individual tiles.

Project Overview

PE Stack worked with a prominent single family office located in Latin America to identify potential platforms for a multi-asset class portfolio monitoring use case. We put together requirements following interviews with key stakeholders which were used to pre-qualify potential vendors. We then set up demonstrations and maintained a consistent assessment framework to aid with decision-making.

Project Overview

We love ambitious market intelligence projects and were excited to work with data science and business development teams to identify, assess and compare multiple traditional and alternative market data sources to power an advanced deal sourcing engine. Integration with CRM and price negotiation/consideration was also a key factor in this project, as was a consideration of overlap between various datasets.

Project Overview

Micro-VCs need quality software and data just as much as their larger counterparts, and we have tracked a number of new platforms launching to cater for this area in recent years. Our client here was a micro-VC fund operating out of the MENA region. We worked to strategize and evaluate CRM, portfolio monitoring and data solutions – including all-in-one platforms as part of the engagement.

Project Overview

PE Stack is acutely aware of the importance of achieving data consistency and accuracy when implementing a ‘best of breed’ software application strategy. We helped our client, a growth fund, to formulate a data strategy, including recommendations around validation and centralized resources, before providing intelligence on key vendors and options within this space.

Project Overview

Client was happy with CRM for sourcing, but wanted more structure for pipeline management… Not happy with current portfolio monitoring… Three different fund admins across active funds meant the same LPs logging into three different portals… PE Stack was able to navigate these complex considerations and help find the right solution with a robust plan for implementation, integration and onboarding given the complexity involved.

Project Overview

Effectively leveraging market data for private company sourcing is deceptively complex. Not only are there overlapping datasets from competing vendors to consider, but also the level of data access required, CRM integration and associated costs, duplication rules and more. We worked with our client to map out both traditional and alternative sources of market data, helping to select multiple vendors via web, CRM and raw data access.

Project Overview

In a world where vendors claim to offer all things to all firms, the potential for frustration and wasted time is significant when strategies dictate specific deal-breaker requirements. PE Stack’s venture debt client's demands around loan book monitoring immediately disqualified certain solutions from our search (to the benefit of both client and vendor in terms of efficiency!)

Project Overview

PE Stack maintains an agnostic perspective towards considerations such as best of breed vs. suite solution. In this case our client, a first-time fund, had a strong preference for a suite solution and PE Stack helped to identify and pre-qualify vendors, arrange demonstrations and line up contracts to coincide with a first close. We strongly recommend first time funds consider technology ahead of a fund close to achieve clean implementation and prove to prospective LPs they are serious.

Project Overview

VC firms which maintain accelerator programs face challenges in identifying the right platform for tracking portfolios and managing multiple, complex sourcing channels. We worked with our European client to identify products with the potential to align with their unique strategy. A big part of this came down to pricing structure- we were able to dismiss certain vendors unable to adapt models to account for a large volume of small investments for the portfolio monitoring use case.

Project Overview

While there is a good deal of crossover with traditional PE, infrastructure funds often have specific requirements – such as real-time output monitoring. We helped our client to identify the best aligned platform bearing their specific needs in mind, including maintaining non-uniform reporting standards for different portcos as a key data ingestion requirement.

Project Overview

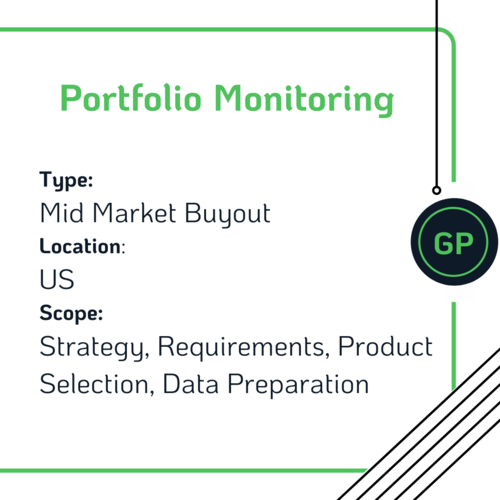

Portfolio monitoring is one of the most common project requests we get at PE Stack. Our client, a prominent mid-market buyout firm, was seeking to evolve its monitoring capabilities in line with increasing complexity and growing ESG requirements. We put together a strategy, wrote up requirements and help to qualify vendors across two rounds of demonstrations, including a proof of concept, allowing our client to make an informed decision as part of an efficient process.

Project Overview

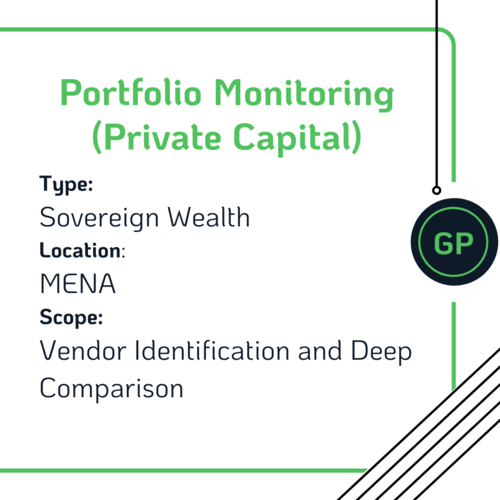

They all say they do everything, but which vendors actually have the right functionality?” Our recommendation (in addition to using PE Stack from the outset next time) was to build a robust comparison framework aligned with their key requirements. We leveraged our proprietary intelligence and engaged with vendors to collect meaningful data showing each vendor’s ability to provide required functionality, allowing our client to make an evidence-based recommendation to senior management.

Project Overview

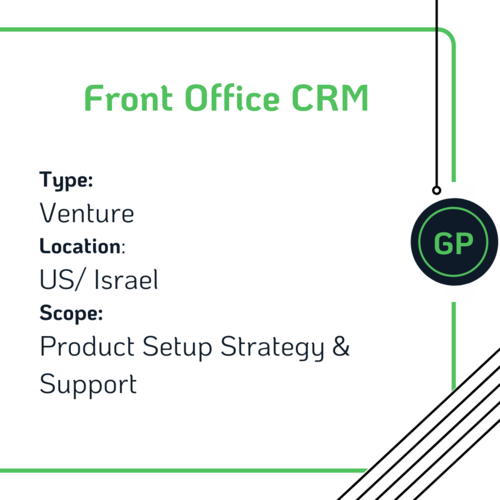

Our international VC client maintains complex relationships with its stakeholders– it shares dealflow with LPs, partners with other GPs, makes strategic introductions for portfolio companies and more… With many hats being worn, setting up a CRM to track things effectively is a challenge. PE Stack leveraged knowledge of key workflows and experience with Affinity and other platforms to execute a successful implementation strategy.

Project Overview

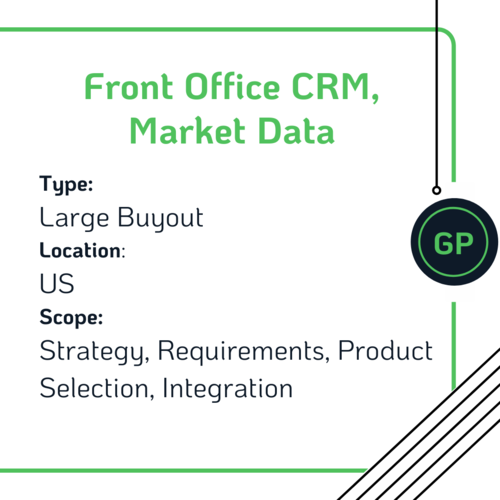

Integrating market data with CRM can provide considerable value, but entails extra cost and compatibility considerations. Evaluating both at the same time, as PE Stack did in this case, can therefore be a wise strategy to ensure robust integration and maximize negotiation leverage. The project resulted in a successful implementation of a fully integrated solution for sourcing and executing deals.

Project Overview

Previously reliant on Excel and ad hoc analysis, our client – an established name in the mid-market – was feeling pressure to modernize its portfolio monitoring capabilities. We worked with the team to successfully identify a solution which would create efficiency and capability while ensuring that all stakeholders, including those with a more traditional mindset, would feel comfortable with the transition.

Procurement doesn’t have to be painful… reach out to see how we can help you.