MJ Hudson's private equity fundraising and fund due diligence software push continues with the PERACS acquisition. We analyze previous data and analytics acquisitions and evaluate how these tools can work together to streamline fundraising.

Private Equity Middle Office Solutions Map – Portfolio Monitoring, LP Reporting, and Data

CEPRES and Bain Partner Up to Transform M&A Due Diligence Analytics

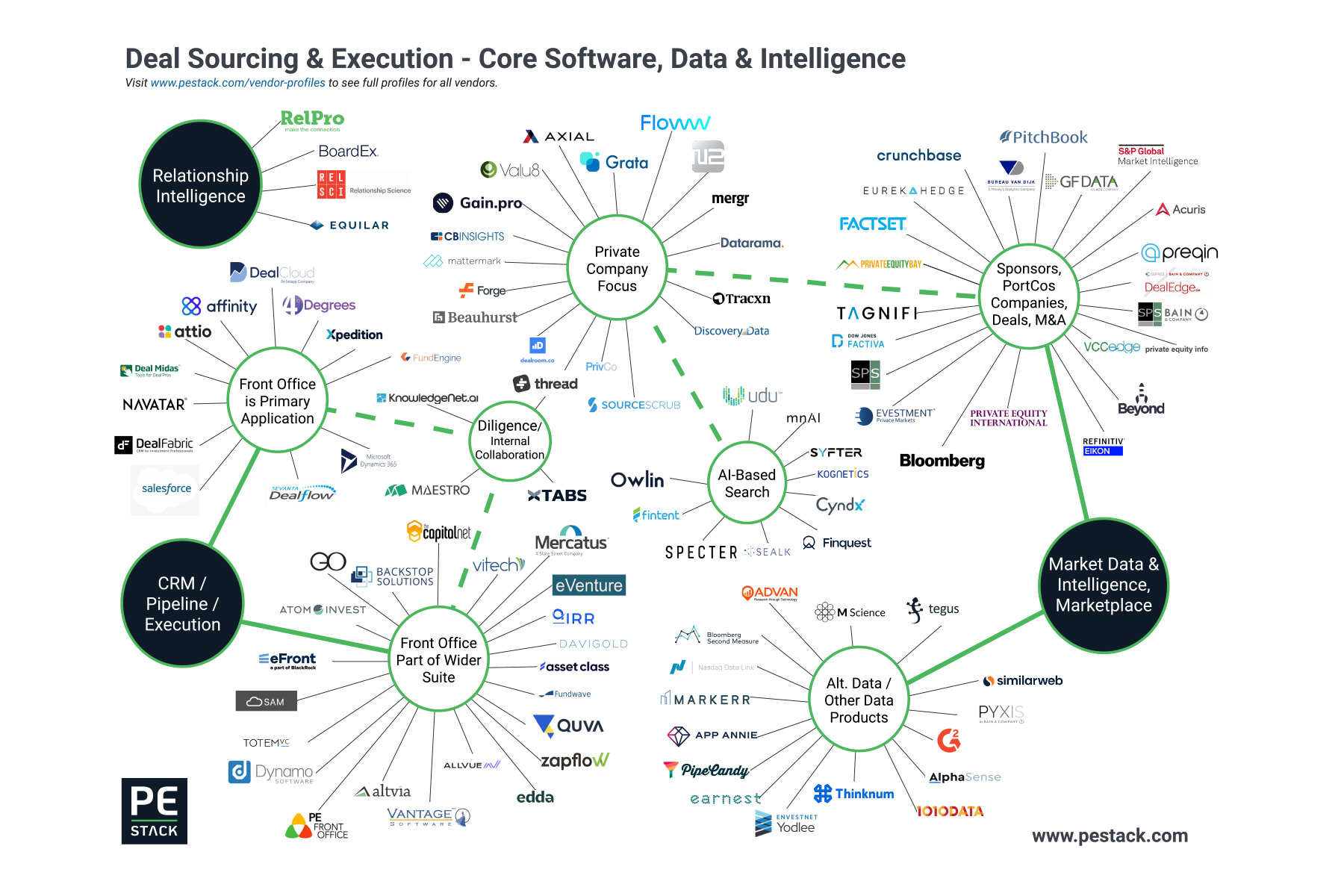

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

eVestment adds Enhanced Reporting Functionality for Fund Managers Using TopQ

Virtual Analysts - the future of proprietary deal sourcing?

Our latest special report, produced in collaboration with udu, examines emerging 'Virtual Analyst' technology and the increasingly important role it's playing in proprietary deal sourcing channels:

What is a 'Virtual Analyst'?

How does the technology work?

Why is it so important in the current market?

How does adoption affect existing sourcing processes?

An LP's Fiduciary Duty?

In a ‘buyers’ market’ fundraising environment, the onus tends to fall on fund managers to adapt and prepare for a demanding and extended process. But what about LPs? After all, almost all LPs have a fiduciary responsibility to their stakeholders to engage in a best-practice fund sourcing process. As the ratio of available funds to planned commitments gets ever-larger, LPs must also consider how their processes must evolve if they are to retain confidence in their ability to select the best funds.

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.