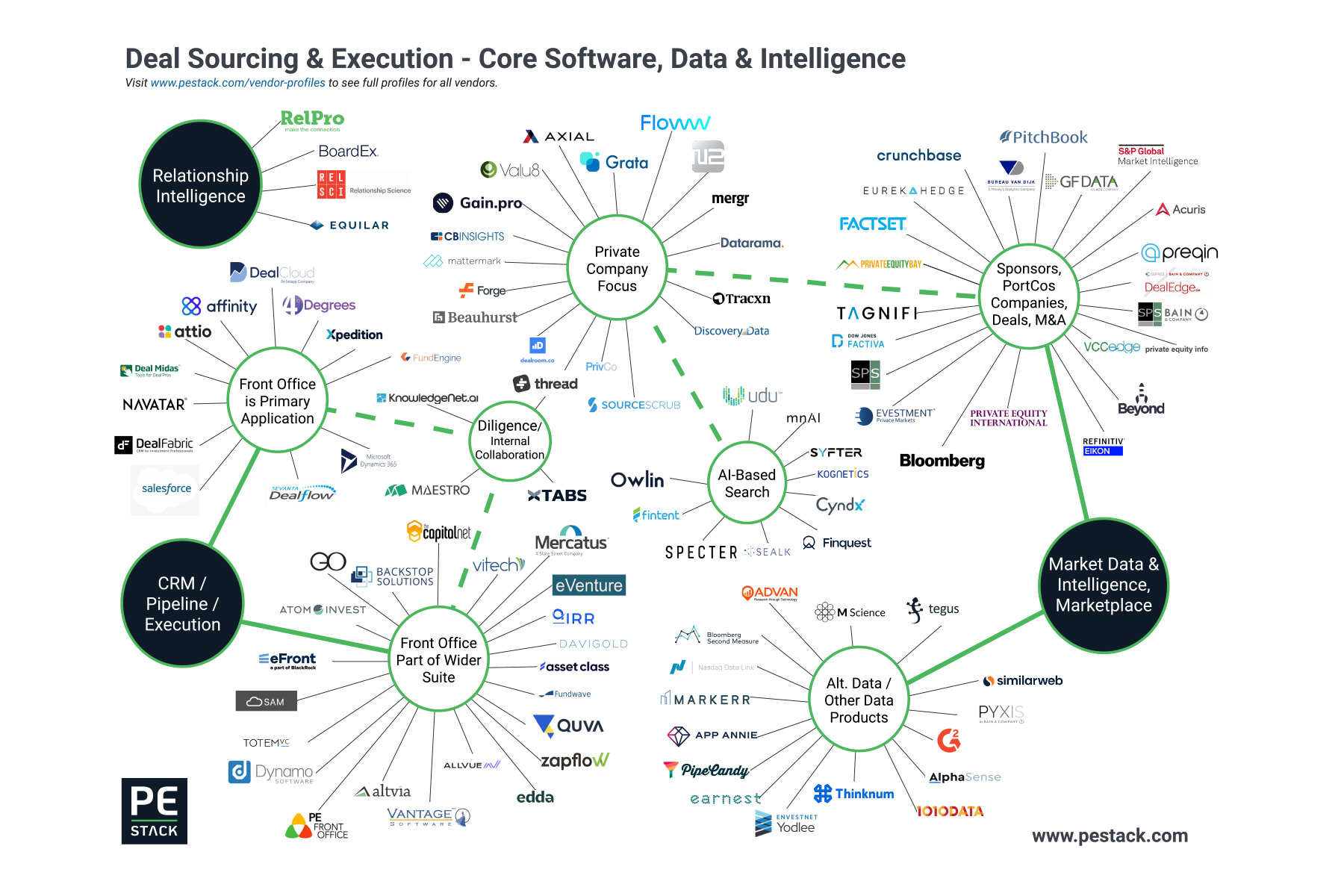

PE Stack's solutions map shows all private equity and venture capital specialized technology, software and data vendors providing services in the portfolio monitoring and wider middle office space alongside concise descriptions of the different technologies being used in this area.

Private Equity Front Office Solutions Map - Sourcing Deals and Raising Funds

Morningstar Continues Private Markets Push with Allocator Investment

Nasdaq in Private Equity: eVestment, Solovis & More...

Major financial platforms’ forays into private capital have transformed the product landscape in recent years, and activity shows no signs of slowing in 2020 with multiple partnerships and investments already announced. Following its recent investment in data optimization specialist Canoe, we take a deeper look at Nasdaq, one of the most active and exciting participants in the market today.

S&P, Preqin and the Death of the Private Capital Silo

Preqin and S&P’s data partnership is the latest in a series of high-profile deals involving private capital specialists and broader financial data and software providers. We have some strong views on this emerging pattern and what it means for end-users, vendors and those doing deals in the financial data and technology industry.

Affinity adds Pitchbook Integration

Affinity, a leading relationship intelligence platform (click here to view our primer on Relationship Intelligence) today announced a new integration with Pitchbook, a leading provider of financial data and technology.

Users of Affinity will now be able to see additional investor and company data directly on the Affinity platform, allowing for:

Companies: Get information on the industry, location, demographics, financing, assets under management, and more on both public and private companies.

Investors: Review details on a company’s investors and assess fund performance to gauge their experience.

Funding: Explore granular funding data, including funding type, amount, date, and post-money valuation.

If you are an Affinity user (full disclaimer, PE Stack uses Affinity and we love it) then you won’t need any further explanation. But for the uninitiated , here’s why this integration is so important.

Affinity helps its users to understand relationships and improve business development and outreach through its intelligent mapping and prediction models. Adding sources of third party data allows for:

More intelligent outreach: through allowing users to better understand a target company’s current situation with funding, financial status etc.

The discovery of new and adjacent routes to forming relationships: by seeing which companies worked with other companies. For example, discovering and then leveraging existing relationships with investors in a target company to gain warm introductions.

Saving valuable time: by eliminating the need to have two platforms open at the same time, searching via two different platforms, manually importing information.

In order to access the data, users will need access to both platforms.

For more information on Affinity, Pitchbook, and other data and relationship intelligence tools, please view our free Vendor Profiles platform, or give us a call at our Los Angeles office - +1 818 964 1576

eVestment Continues Data Expansion Drive with Preqin Integration

The growth of the private fund market is having a major impact on the dynamics of the software and data industry that supports it. For today’s allocators, there is enormous complexity in terms of the number of offerings to choose from and the breadth of strategies and industries being targeted. As the proportion of assets being placed in alternatives rises, the pressure to perform has never been higher.

Allocators, even those reliant upon consultants, are increasingly turning to software and data solutions to help them manage their programs effectively. We have seen a number of new products targeted toward this sector both from existing players expanding their offerings and start-ups seeking a foothold in a fast-growing market.

For me, eVestment has been one of the most interesting companies to track, and today sees the announcement of another data integration partnership to follow on from the recently announced deal with Pitchbook, with Preqin’s industry benchmarks make their way onto eVestment’s Private Markets product.

I feel that eVestment is taking a customer-centric approach to developing its suite of products, employing a willingness to work with widely-used datasets in order to increase existing clients’ satisfaction and better attract new users to its ecosystem. It’s a smart strategy.

Having a trusted source of market data is now an integral part of the portfolio management process for allocators serious about managing their programs effectively. Software solutions which do not facilitate the integration of trusted market data sources will increasingly find themselves at a disadvantage in an environment where this functionality is becoming more common. As I mentioned in an earlier article, users are also discerning when it comes to the quality of these integrations too.

It is encouraging to see software providers providing clients with multiple options when it comes to data integration. I have heard all the arguments about the relative strengths and weaknesses of the various databases and benchmarks, but the reality is that allocators need consistency. It is far easier to sell an allocator on an excellent analytics platform if they can immediately utilize the benchmarks which they are already using to track performance.

eVestment should be applauded for successfully taking a number of standalone products such as TopQ and Public Plan IQ and creating an interconnected suite of tools which is supported by high quality external data sources. The integration of Preqin data into the eVestment Private Markets platform reinforces eVestment’s commitment to giving their allocator clients exactly what they want and need to do their jobs effectively.

PE Stack’s thoughts on Pitchbook and eVestment’s Data Partnership

Two of the leading names in the private fund data world recently announced a partnership that sees Pitchbook’s fund performance and firm data available to users of eVestment’s Private Markets product. In addition, Pitchbook’s benchmarks will also be accessible to eVestment users.

What PE Stack says:

Since the NASDAQ acquisition, eVestment has been one of the most exciting vendors to watch, with this deal the latest in a series of acquisitions and partnerships that have enabled them to gather serious momentum in the private fund space.

I know first-hand that building and maintaining a high-quality source of performance data is tough, both in terms of assembling the data set in the first place, but perhaps more importantly in terms of building a good reputation. Pitchbook is one of a select group of trusted vendors with performance data and benchmarks which are high-quality and suitable for vital tasks such as due diligence.

I believe that by partnering with Pitchbook instead of building a competing dataset, eVestment put themselves in a strong position where their excellent tools and analytics can be accessed without having to convince users to switch to a new set of benchmarks and performance metrics. Don’t under-estimate how important consistency is for many GPs and especially LPs in the space.

It’s a smart strategy that will allow eVestment to attract new clients at a fast pace – especially on the GP and LP side. For Pitchbook, this move cements their position as a trusted provider for fundraising and due diligence data, and will increase their exposure to end-users on both the supply and buy side of the fundraising market.

I expect to see more deals which bring external data sets directly into eVestment’s growing ecosystem. Their mix of high-quality internal data products (Public Plan IQ), powerful tools (TopQ) and willingness to incorporate external data sources is unique in the market today. What makes the offering especially compelling to me is the effort that eVestment have put into integrating their portfolio of products into a powerful, inter-connected suite.

For more information on the specifics of the deal, please see the information page here:

https://www.evestment.com/privatemarkets/pitchbook-data-partnership/